Capital Region Advancement Fund

What is the Capital Region Advancement Fund?

The Capital Region Chamber administers the Capital Region Advancement Fund which provides low-interest loans to help area businesses. Funding has been used for working capital, purchase and improvement of real estate (cannot go toward investment income-based businesses such a non-owner-occupied real estate), and the purchase of furnishings, fixtures, equipment, and other fixed assets.

This is a revolving loan fund, so as the initial loans are paid back, other businesses will have access to financing for years to come.

This fund is not an income replacement program or a grant program.

The fund is available to for-profit businesses located in Albany, Columbia, Greene, Rensselaer, Saratoga and Schenectady counties. Please see below for eligibility requirements.

Advancement Fund Highlights:

- Loan amounts of $25,000 – $500,000

- Terms ranging from 5 – 20 years (depending on use of proceeds)

- Interest Fixed at the closing of the loan at below market rates – equal to 75% of the current Money Center Prime Interest rate quoted in the Wall Street Journal on the closing date

- Low closing costs

- No prepayment penalties

- In certain instances, and at the discretion of the review body, principal payments deferred for the first 6 months

Eligibility

Eligible Uses of Capital:

- Purchases and improvement of real estate

- Purchases of furnishings, fixtures, equipment and other fixed assets

- Working Capital

Eligible Applicants:

- Must be in business at least 18 months at the time of application

- Must be a for-profit business in one of the six counties covered by the Fund (Albany, Columbia, Greene, Rensselaer, Saratoga and Schenectady)

- Can demonstrate repayment ability, either through historical or projected financial information (adequately vetted and analyzed by staff)

- Funds will help in the retention and/or creation of existing jobs (including self-employed individuals)

- All requests must be secured by sufficient collateral

- Membership in local, county or regional chamber is not required

Restrictions:

- Cannot have any bankruptcies or foreclosures over the past 3 years

- Funds cannot go toward investment income-based businesses (i.e.: non owner-occupied real estate)

Process:

- Interested business or referral partner contacts Chamber at funding@capitalregionchamber.com

- Applicant company receives link to submit application and related materials via online platform

- $500 non-refundable application fee

- Materials are pre-screened for eligibility requirements and follow-up questions

- Completed and fully vetted application reviewed during regularly-scheduled loan committee meetings

Click here to read about business owners who utilized the Capital Region Advancement Fund to keep their business alive during the pandemic.

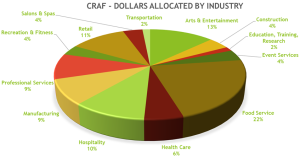

How has the money been invested so far?

|

|

|

| *Click on each chart to enlarge |